History. Convention. That’s the simple answer.

Governments have always needed money to function, even democratic governments, but until about 150 years ago, they have not needed a great deal of money – unless a war was being financed. At the time of confederation and beyond, the Canadian government depended almost entirely on tariffs and excise taxes – taxes paid at the border for goods brought in, but also taxes on beaver pelts and other furs exported.

Even property tax was minimal because there was all this “unoccupied” land in western Canada, and the federal and provincial government were wanting settlers to occupy this land. A tax on land at that time would have been a disincentive to settlement.

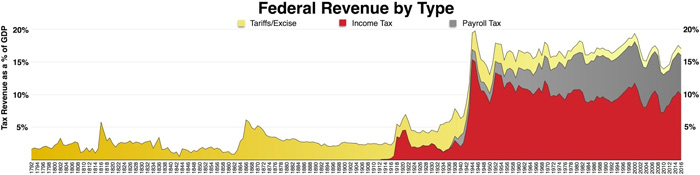

This taxation system worked until WWI when more revenue was needed to finance the war. There is a principle that taxes should be based on a person’s ability to pay. It seems this principle was applied in Canada as a graduated income tax was introduced at that time. The more income a person had, the more tax he could and should pay. This yielded federal revenue.

Around this time, municipalities and provinces also began looking for more revenue, primarily to finance education and the building of roads. The principle that taxation should be based on the ability to pay, seems to have prevailed here too. Municipalities have implemented a specific form of wealth tax, namely a tax based on the market value of property. This tax does not distinguish between land, which is property, and improvements to that land which are result of the industry and activity by the land owner.

In 1991, then Prime Minister Brian Mulroney, brought in the GST, which is a very different form of tax. This tax is based on consumption. It seems the principle behind this tax seems to be that if people wish to behave in a particular way, they should pay. The current controversial carbon tax is a discriminatory consumption tax levied on one item only – oil and coal. We don’t all agree on whether this discrimination is reasonable and fair.

Anyone who has paid taxes in Canada knows that our system is much more complex than what I have said above. There are payroll taxes, gift taxes, inheritance taxes and more. But I have outlined the above in order to make a point. Historically these taxes were all applied because they seemed reasonable at the time. It does not follow that these particular taxes are the most appropriate today. The question we should ask is whether these taxes encourage desirable behaviour.

Taxes have, historically been levied because a government needs money. That’s fair. We want services from our government, so we need to pay for them. But, it seems to me, modern, progressive taxes should do more. Taxes should be carefully designed, and carefully examined to see what behaviour they encourage. We may not all agree with what behaviour we want to encourage, and in a democracy that question needs to be discussed. But that question should not be confused with the other question: the question of how much tax we should pay. Unfortunately our political parties tend to confused the two.

In our next post we will examine how taxes affect our behaviour.