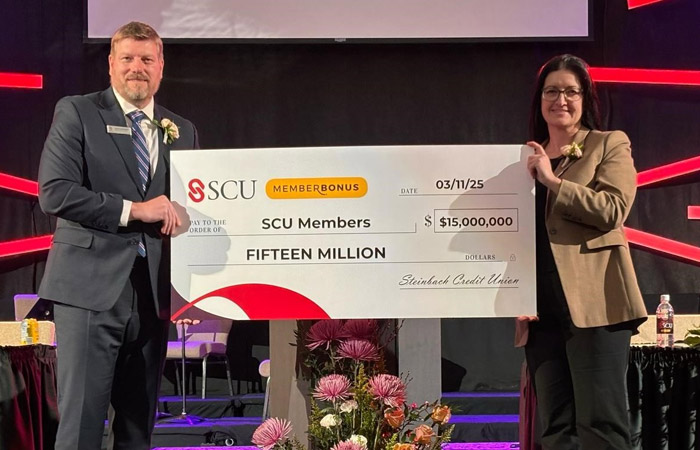

Steinbach Credit Union (SCU) members will once again benefit from being part of one of Manitoba’s largest credit unions. Board Chair, Maria Reimer, was pleased to report another strong fiscal year for SCU in 2024. To share this success with their members, Reimer announced a Member Bonus of $15 million in cash. This is the largest cash Member Bonus in Manitoba credit union history, to date.

Reimer began the meeting by recognizing that 2024 was a year of transition in leadership as she introduced Curtis Wennberg, SCU’s new Chief Executive Officer, who began his role in February after the retirement of Glenn Friesen. “Curtis brings a wealth of experience and a visionary approach to leading world-class organizations in financial services and beyond. The Board is confident that Curtis will build on Glenn’s legacy and lead SCU into an exciting new chapter of profitable growth, member service, and innovation.”

“SCU is a leader in the Manitoba credit union landscape and, in the short time I’ve been here, I’ve come to appreciate what makes us truly unique,” says Curtis Wennberg, CEO. “Every day, our team comes to work with a shared purpose – to help our members build their best financial future. That commitment is reflected in everything we do, from providing tailored financial solutions to maintaining a strong foundation of stability and trust.”

In 2024, SCU’s growth continued with the addition of 7,756 new members and asset growth of 7.5 percent, allowing them to achieve a significant milestone – the first Manitoba credit union to reach $10 billion in assets without mergers or acquisitions. In addition, SCU’s deposit growth increased by 6.3 percent and their loan growth by 6.9 percent. Reimer notes, “As we look ahead, technology will continue to play a critical role in our strategy to remain relevant, competitive, and viable. We understand that our members expect convenience, ease of doing business, security, and trustworthiness, and we are committed to delivering on these expectations every step of the way.”

As a cooperative organization, SCU believes in sharing profits in the form of a 100% cash-back bonus with their members; a practice the credit union has employed for many years. The bonus will be shared with members who hold deposit or lending accounts. The breakdown of this allocation will be 60% to deposit holders and 40% to credit holders.