Manitoba Public Insurance has requested no overall rate increase for the 2016/17 insurance year in its general rate application filed with the Public Utilities Board. If approved, this would be the 12th time in 15 years that Manitoba’s public auto insurer has not requested a rate increase.

“With the PUB’s approval of last year’s rate application, we were able to apply to hold the line on rates this year.” Dan Guimond, President and Chief Executive Officer of Manitoba Public Insurance said today. “This rate application confirms the strength of the public auto insurance system.”

Guimond explained that last year’s rate application approved by the PUB (3.4 per cent overall increase) helped to ease the deficiency in premiums that was being experienced by the Corporation. Normal levels of claims costs being forecasted and the Corporation’s ongoing efforts to control operating costs, has resulted in not requiring a rate increase for 2016/17.

The Corporation’s financial strength has been further stabilized with the transfer of $75.5 million to the Basic rate stabilization reserve from non-Basic lines of business.

“Our Corporation is committed to rate stability and predictability for our customers,” said Guimond. “Over the last five years, the yearly average rate change for a passenger vehicle has been about minus one per cent. The Corporation will continue to move forward in customer service and cost efficiencies.”

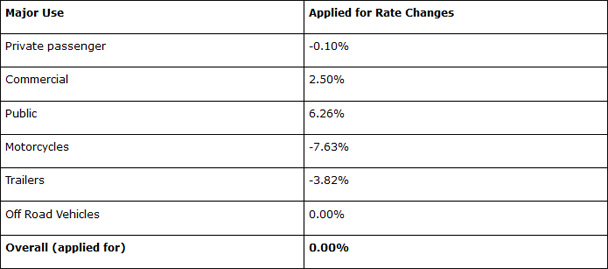

While the Corporation has requested no overall rate increase, the rates individuals pay for Basic Autopac will be determined by their driving record, the kind of vehicle (make, model and year) they drive, what the vehicle is used for and where they live. In any given year, an individual’s premium may be adjusted based on the actual claims experience associated with these rating factors.

If the application is approved by the Public Utilities Board, 547,032 vehicles receive reductions in their Basic premium next year, while another 78,442 vehicles will remain the same.

The proposed rates will be effective March 1, 2016 but because renewal dates are staggered, some vehicle owners wouldn’t pay the new rates until February 28, 2017.

Motorcycle Rates

The Corporation has requested a 7.63 per cent overall average decrease to motorcycle rates (including moped and motor scooters). If approved, 95 per cent of motorcycles will receive a decrease in rate, while 5 per cent will increase. In total, 14,062 motorcycle owners will receive a decrease in their premium. The majority of those owners are registered in Winnipeg and central and western Manitoba.

Mopeds and small-engine displacement motor scooters (2,729 units) will experience an average rate decrease of $12 to $310 per year, down from $322.

“Over the last five years, motorcycle rates have decreased overall by 28 per cent,” said Guimond. “The Corporation will continue to work with the Coalition of Manitoba Motorcycle Groups relating to both safety and rates.”

Annual Report

Manitoba Public Insurance also released its 2014 Annual Report this week. The report demonstrates the company’s current financial strength and ability to continue to deliver the value Manitobans expect.

Manitoba Public Insurance reported net income from operations of $57.6 million. Investment income of $226.1 million was a significant contributor to the overall positive corporate results. The Basic plan also surpassed its goals by providing claimants with $1.09 in benefits for every $1 in premium – significantly better than the national average.

In addition to positive financial outcomes for the 2014 fiscal year, Manitoba Public Insurance also met or exceeded corporate-wide customer service standards 96 per cent of the time.

Last year, Manitobans filed an average of 1,102 claims every working day. This represents about $2.7 million in claims every working day.